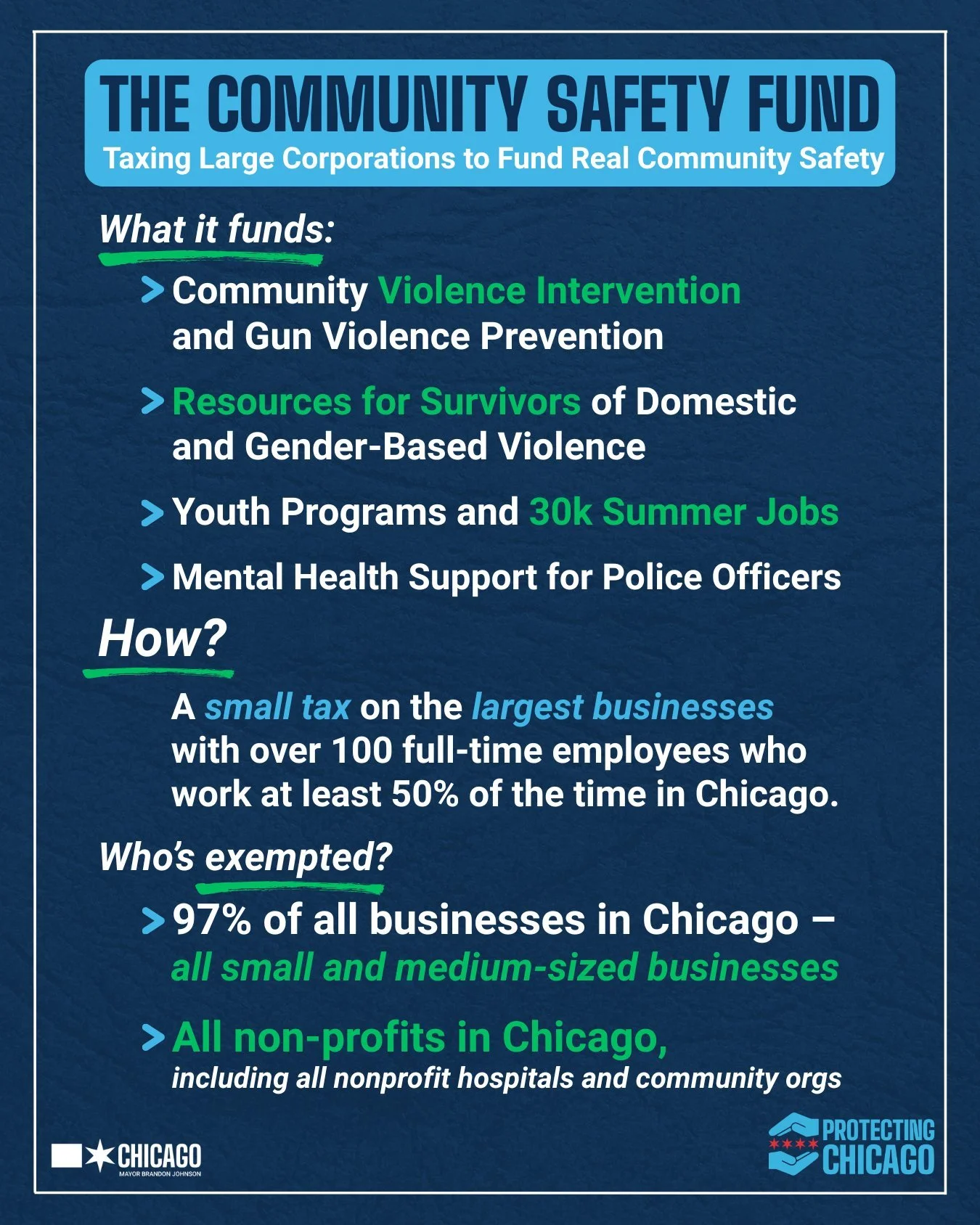

What is the Community Safety Fund?

The proposed budget for 2026 establishes a Community Safety Fund in which corporations with 100+ employees will pay a monthly, per-employee surcharge to fund community safety initiatives including violence prevention, youth employment, survivor support, and officer wellness programs. Below, we answer some of the most frequently asked questions about the Community Safety Fund. For a more general overview of this year’s proposed budget, watch the recording of our 2026 Budget Town Hall.

FAQ

Q: Who is exempt from this surcharge?

A: Small businesses, medium-sized businesses, and nonprofits. Because this surcharge is for large corporations with 100+ full-time employees, small and medium-sized businesses will be exempt. All Chicago nonprofits, including nonprofit hospitals and community organizations, are also exempt.

Q: Can the affected corporations afford to pay the surcharge?

A: Yes. The initial plan proposed that the largest 3% of businesses contribute 0.4% of their typical payroll to create this fund. This cost is minimal when considered in the context of the Trump Administration’s corporate tax breaks:

The top 20 public companies made $324 billion in 2024.

The top 20 public companies saw $60 billion in tax breaks (as a result of Trump Administation tax cuts)

The initial plan for a Community Safety Fund proposes that <0.06% of that $60 billion be used to fund community safety initiatves, which many businesses state is a priority.

Research by Institute for the Public Good (IPG).

Q: What does the Community Safety Fund pay for?

A: The fund supports community safety initiatives including gun violence prevention, resources for survivors of domestic and gender-based violence, youth programs and summer jobs, mental health support for police officers, and more. These safety services are an essential part of a budget that truly centers the needs of all Chicagoans and a stated priority of many businesses looking to move and stay in Chicago.

Q: Won’t affected corporations leave Chicago due to comparatively high taxes?

A: No. Recent IPG research shows that Chicago is in the bottom half of the top ten economies in corporate-level taxation, and last of the top 3 economies (see chart below): “The notion that Chicago is a higher direct-corporate tax structure than peer economies is false. Chicago lags its peer economies in corporate taxation.” Read more about how Chicago stacks up to New York City, Los Angeles, Philidelphia, and other major cities here.